How similar are follow through bars to previous bars?

This study attempts to prove or disprove a hypothesis that a bar's appearance affects the bar that comes next. It

compares all pairs of consecutive bars in a very large dataset and assigns a similarity score to all the

follow through bars.

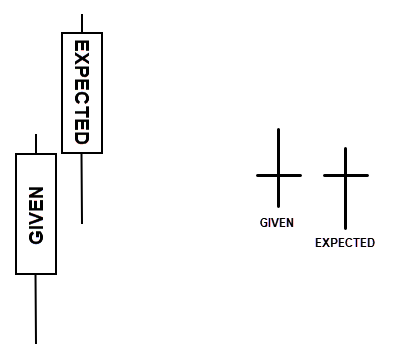

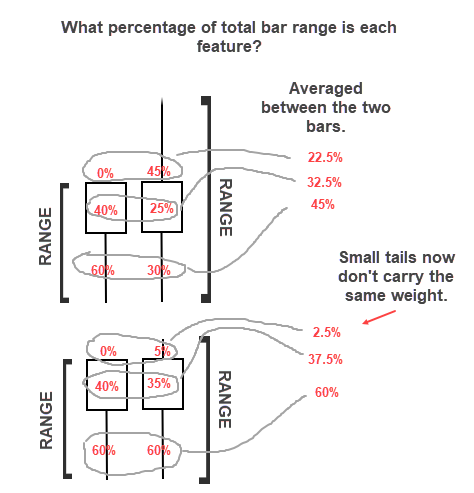

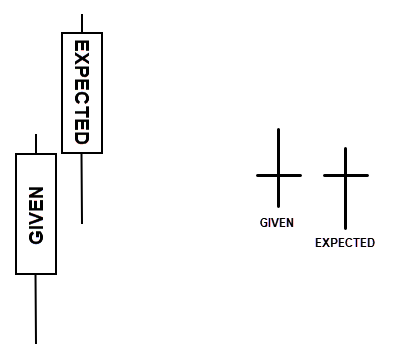

Visually the question asks if regardless of whether a bar is a trend bar or a doji, to what extent will the

follow through bar look similar (not necessarily exact but close)?

Methodology

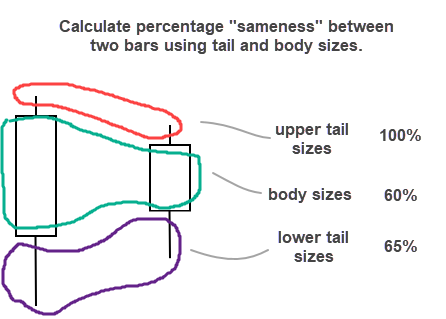

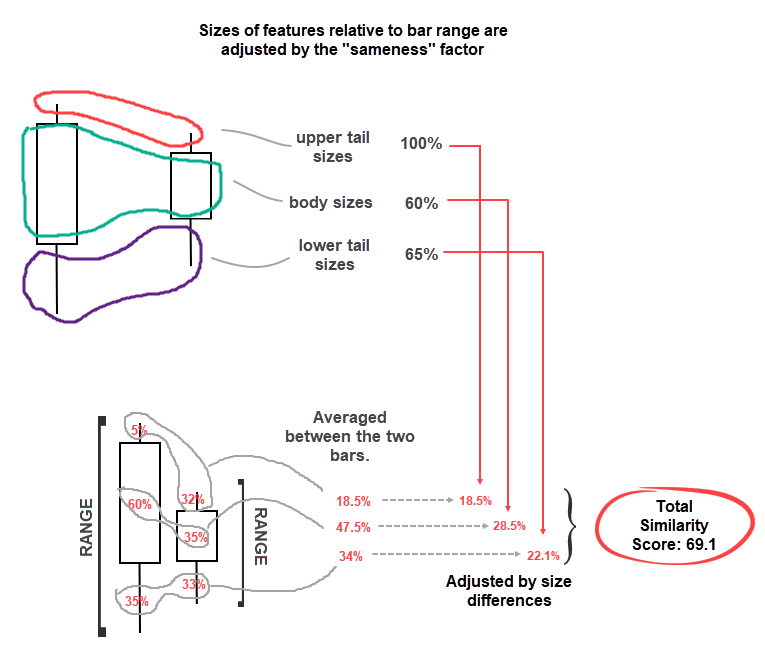

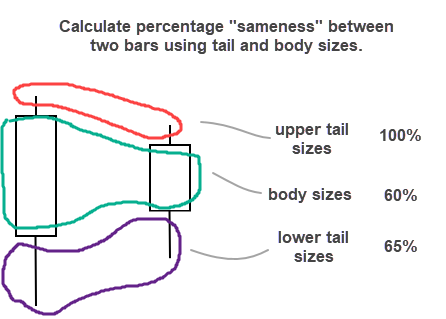

The similarity function uses the three main features of a bar: upper tail, lower tail and body. It then

calculates percentage difference between two given bars for each feature separately. For example, if the upper

tails on each

of the bars are exactly the same size it scores the tails at 100%. If one bar has a tail and the other one

doesn't it scores that feature as 0%. Similar process is repeated for bodies and lower tails. If the follow

through bar is of an opposite color to the previous bar

then

the whole process defaults to 0% and comparison moves on to the next pair.

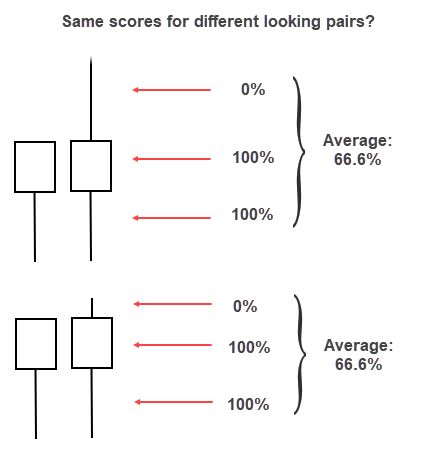

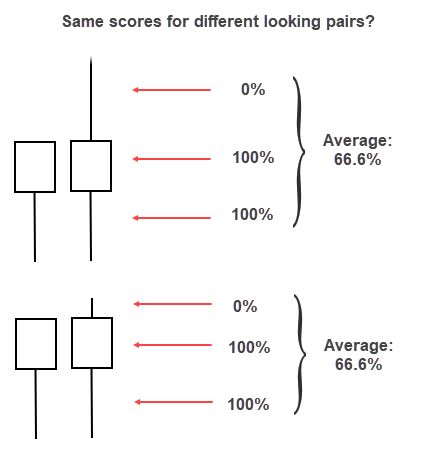

It's tempting to just average the scores now and be done with it, but there's a catch: since the similarity

function defaults to 0% as soon as one of the bars doesn't have a tail and the other one does, it creates a

situation where two pairs of different looking bars end up with the same score, which doesn't seem correct.

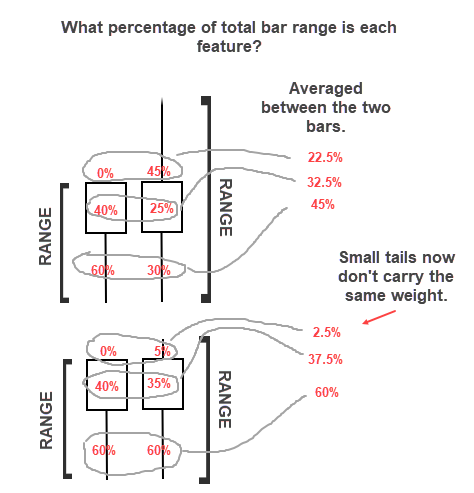

A workaround is to first evaluate the sizes of each feature relative to the range of a bar. That way, if the

tails are small compared to the rest of the bar they won't weigh as much on the final result.

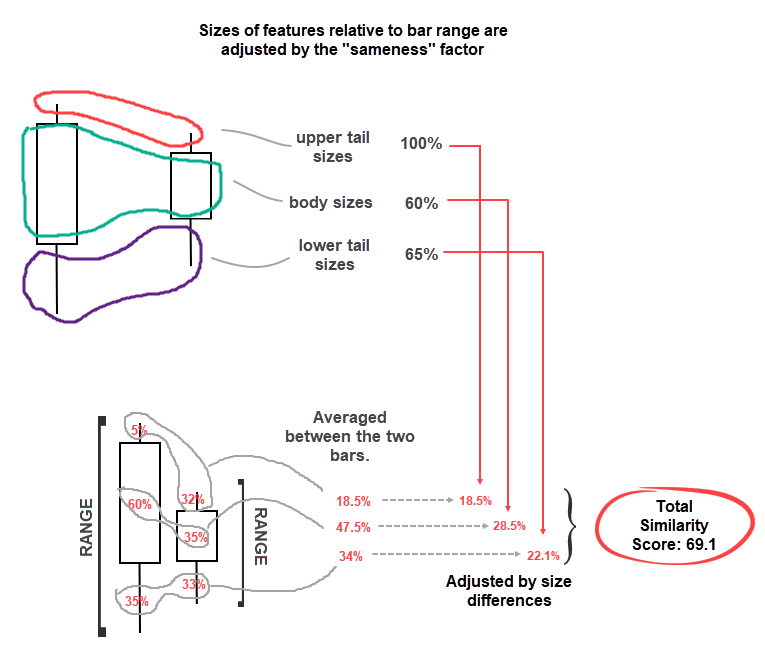

And now for the final magic trick, we use the size comparisons calculated at the very beginning to offset these

weights.

That was easy. We now have our similarity score function working and can run it against the historic dataset.

Results

Now comes the fun part. This process was run on over 337K bars so any context that may have influenced follow

through bar behavior would've been canceled out. We'll use histograms to analyse the results. If the hypothesis

is correct then the majority of follow through bars will cluster around the upper range of the similarity

function.

Result 1

Oh no! What's going on? There is a huge spike on the left completely offsetting our beautiful similarity function

results. Well, remember that if a follow through bar is of an opposite color the function defaults to scoring it

as simply 0. This result tells us that majority of FT bars are actually more likely to be of opposite color.

There were about 200K FT bars of opposite color. Since this is a historgram, we sum up the rest of the

similarity scores that fall above 0 to give us a count of how many FT bars were of same color: 137K. This means

that there's only a 40% chance to even get an FT bar of same color (excluding any other context).

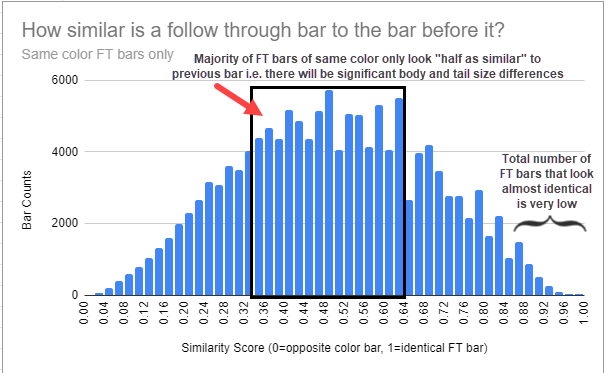

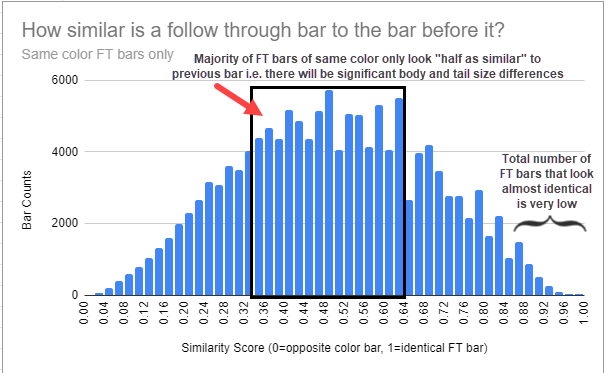

Result 2

Let's isolate just the results greater than 0 and focus on the FT bars that were of the same color. This

result is just as sad. The majority of FT bars of same color cluster around a "half similar" region. What we

were hoping to see, clustering around the upper range of similarity (>0.80 and above) constitutes a very small

percentage of the total.

Conclusion

This empirically disproves the hypothesis that any given bar, taken out of context, has any influence on the follow

through bar. As a word of caution to anyone wanting to use this result to build a countertrend strategy: this result

doesn't say

anything about reversals or strength of moves in the opposite direction. A strong bull bar followed by an opposite

color bar could be just a bearish doji and the trend may still resume higher. This study doesn't cover any of that,

only what or more precisely what

not to expect. As always, traders are encouraged to replicate and test these

results. All the code is freely available on

GitHub.

Risk Disclosures

CFTC Rule 4.41: Hypothetical or Simulated performance results have certain limitations,

unlike an actual performance record, simulated results do not represent actual trading. Also, since the

trades have not been executed, the results may have under-or-over compensated for the impact, if any, of

certain market factors, such as lack of liquidity. Simulated trading programs in general are also

subject to the fact that they are designed with the benefit of hindsight. No representation is being

made that any account will or is likely to achieve profit or losses similar to those shown.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for

every investor. An investor could potentially lose all or more than the initial investment. Risk capital

is money that can be lost without jeopardizing financial security or lifestyle. Only risk capital should

be used for trading and only those with sufficient risk capital should consider trading. Past

performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent

limitations, some of which are described herein. No representation is being made that any account will

or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp

differences between hypothetical performance results and the actual results subsequently achieved by any

particular trading program. One of the limitations of hypothetical performance results is that they are

generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve

financial risk, and no hypothetical trading record can completely account for the impact of financial

risk of actual trading. For example, the ability to withstand losses or to adhere to a particular

trading program in spite of trading losses are material points which can also adversely affect actual

trading results. There are numerous other factors related to the markets in general or to the

implementation of any specific trading program which cannot be fully accounted for in the preparation of

hypothetical performance results and all which can adversely affect trading results.

Trade Results Disclosure: Any trades presented may not have been traded in a live

account and should be considered hypothetical.

Trade/Chatroom Disclosure: Presentations are for educational purposes only and the

opinions expressed are those of the presenters only. All trades presented should be considered

hypothetical and should not be expected to be replicated in a live trading account.

Testimonial Disclosure: Testimonials appearing on this website may not be representative

of other clients or customers. Testimonials are not a guarantee of future performance or success.

See further disclaimers that may

help your understanding.